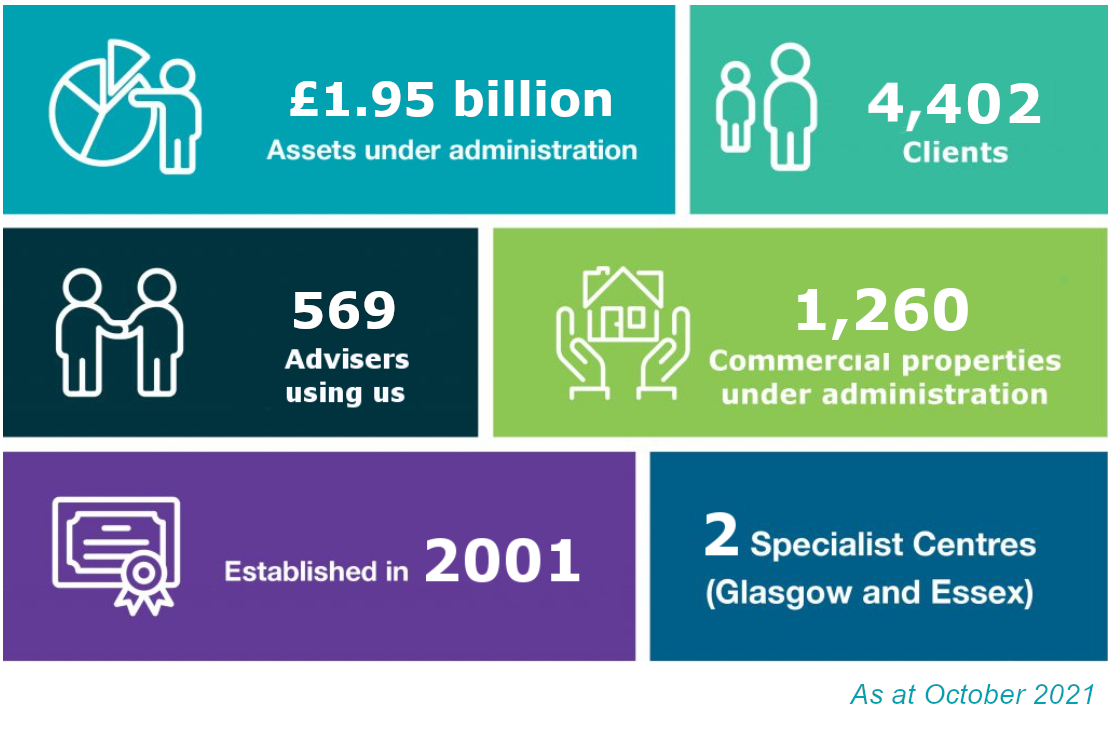

Our key statistics at a glance…

Why should you choose @sipp?

Flexibility. Not only does our open-market structure allow you to select investments for your clients from the whole market, but your clients only pay for the investment options they require at any given point in time too.Independence. Being free from the influence of any parent life insurance or fund management organisation means our focus rests solely on your clients’ needs. In a reducing market, we are a truly full-service administrator.

Robust Financial Strength. @sipp is a well-capitalised business that invests heavily in people, new premises and infrastructure. Our capital reserves would allow us to grow funds under administration by 162% without requiring any additional regulatory capital.

Service Offering. We have built a reputation on the high levels of service our staff provide. We offer the antithesis to a call centre: the ability to build long-term personal relationships with our administration staff.

Technical Expertise. The strength and depth of our technical knowledge is reflected not only in our range of qualifications, but also through our regular press commentary. We are also active members of our trade body, the Association of Member Directed Pension Schemes.

Transparency. Our charging structure is simple. With no hidden costs, it’s clear what your clients will pay from the outset. And through our published Service Level Standards, you can take confidence in knowing exactly how long we will take to process your requests.